Have you ever sat through a house sale or purchase? If yes, you must’ve heard the terms grantor and grantee? Did you wonder what is a grantor? Is the grantee the buyer or seller? Grantor Vs grantee, who is who, and what do these terms mean exactly?

When you buy a house, you have the seller and the buyer. Then why do the real estate agents use the terms grantor Vs. grantee? Sometimes the terms used are just different, but the meaning remains the same.

Buying A Home

Buying a home is not an easy task. Apart from the money you need to put into it, there is a lot of time, thoughts, considerations, and planning that goes into buying a home. A house is not a short-term investment like a car or some product you use. It would be best if you considered the future, the next generation, what the area will be like in a few years, and much more.

Once you narrow down all these details and finalize the home you want for yourself and your family, you need to get the documents ready. The legal language and the real estate terms used can be quite confusing.

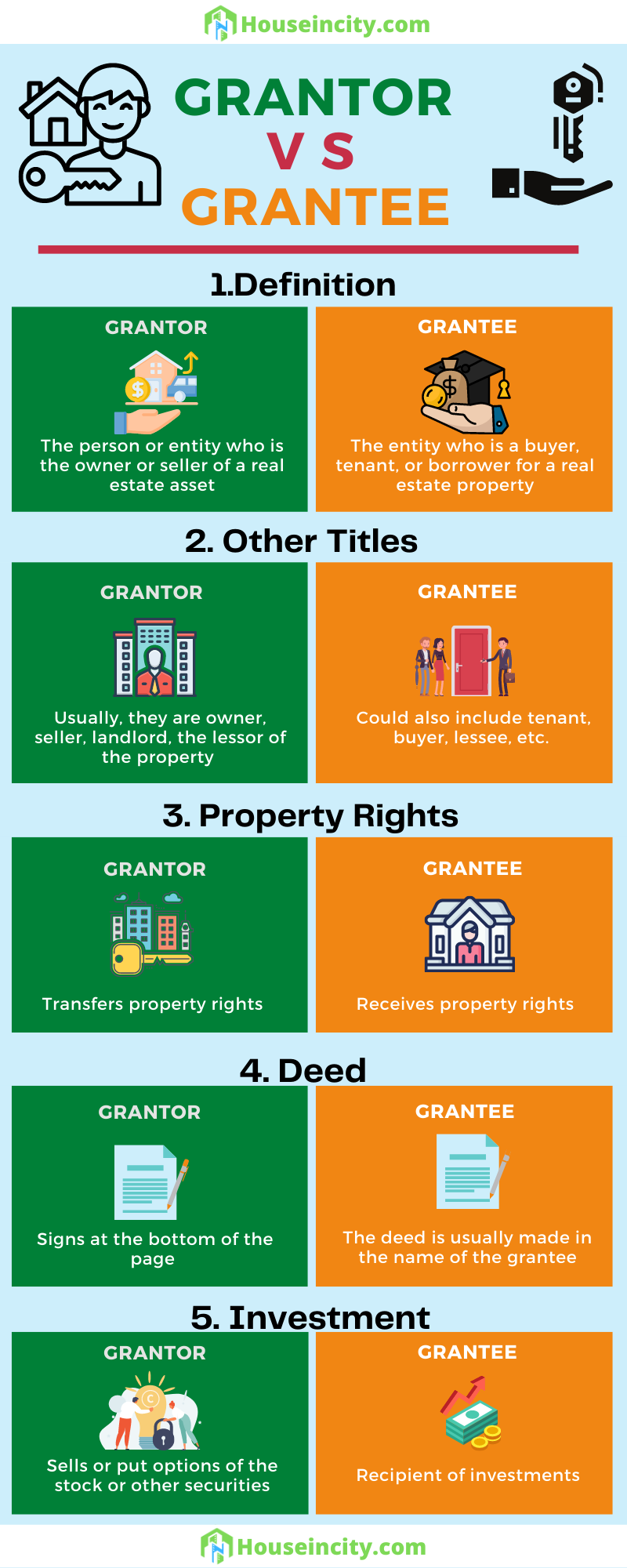

Let’s clearly understand the terms grantor vs grantee real estate agents to use.

Grantor Meaning

A grantor is none other than the seller of the property. A grantor is the one who transfers ownership of their property to the buyer. They sell the rights to their property to the grantee for a fixed sum of money both parties agree on.

Grantee Definition

A grantee in real estate indicates the buyer or the receiver of the property in question. The grantor will transfer the property ownership and rights to the grantee. The grantee will pay the finalized amount to take possession of the property.

Grantee Vs. Grantor

Every real estate deal involving purchasing or selling a house will have a grantor and a grantee. The specifics of the document will vary from one deal to another. The grantor can agree to transfer the ownership after receiving full payment or partial payment. The grantee can take possession of the property immediately or after a while.

So, the difference between grantee and grantor is nothing but who they are in the house sale. They can be known to each other or complete strangers who only meet for the first time while signing the deal. The real estate agent will take care of everything until then.

The Contract

The grantor and grantee get into a legal contract where the grantor agrees to sell or hand over the property ownership to the grantee for certain terms and conditions. The terms vary from contract to contract and depend upon each set of grantor and grantee.

Failing to meet these terms and conditions can even make the contract invalid. The affected party can take legal action against the opposite party who did not fulfill the agreed-upon terms.

A sale deed must contain the following details:

- Parties of the sale – the grantor and grantee.

- Property Description – A detailed description of the property.

- Agreement – What both parties agree to.

- Sale consideration – The amount the grantor agrees to sell the property to the grantee for. This should be clearly mentioned in the agreement.

- Advance – Clear details about how much advance and how many payments the grantee will make

- Payment Mode – The mode of payment must be clearly mentioned. Any other mode of payment will not be accepted in a court of law.

- Title Passing – The deed must clearly mention when the grantor will pass the title to the grantee. Some will agree to transfer it after part of the payment is received, and some will transfer only after full payment is received.

- Delivery Date – the deed cannot go on. There must be an end date. The deed should carry the date by which the grantee will make the payments, and the grantor will transfer the title.

- Default Clause – All deeds must carry a default clause, which will specify details about the course of action in case of defaults – if the grantor or grantee defaults in payment or transfer, what will be the course of action?

Grantor Vs. Grantee Safety Documents

When you buy or sell a property, there are a lot of risks involved. Especially if you are going through an agent and buying a property from a complete stranger in a new area. A few documents help protect the interest of the grantor and the grantee.

- Warranty Deed

The grantor guarantees the grantee that the property is free of any legal issues or hidden problems that can affect the grantee as a new owner. The deed aims to provide added protection for the grantee who is buying the property from an unknown grantor.

The grantee becomes responsible and answerable for any legal litigations related to the property as the new owner. So, the warranty deed is the grantor promising the grantee there are no issues with the property or the transfer of its title.

- Grant Deed

This deed is not as secure as the warranty deed. It is a limited warranty deed, which protects the grantor more than the grantee. According to this deed, the grantor is exempted from any liability on the property created by the previous owner.

So, if a claim is made against the property by a third party who claims the liability was created before the grantor took possession of the property, the liability transfers to the grantee. It does not protect the grantee from such a claim.

- Quitclaim Deed

Unlike the grant deed and the warranty deed, this deed does not protect the grantee from any title-related issues or problems in the ownership of the property. The grantee gets no protection in case the grantor sold the property with title issues and other problems.

This type of deed is generally used in very few cases only. It can be used to transfer the title from a trust or from one family member to another. The aim of using such a deed is just to transfer the ownership.

Since there is no protection for the buyer here, both the grantor and grantee must accept they are taking a risk and are ready to do it.

- Special Warranty Deed

Another deed that aims to protect the interest of the grantee. When a grantee and grantor sign a special warranty deed, the grantor accepts and guarantees the property is free of any legal litigations and title-related issues.

The grantor assures they have paid off all liabilities and debts on the property during their period of ownership. They are not responsible for the previous owner’s defaults.

Deed In Lieu Of Foreclosure

Many take loans to buy a house or a property. A property is an asset they can borrow loans against too. A property owner can take out a loan or two against their property. If they do not pay it back in time, they are at a risk of foreclosure, where they will lose the title to the property.

It can be a lengthy legal process, which can quickly become expensive. To avoid this, the grantor or property owner might decide to sell off the property to the mortgage owner itself.

So, the deed in lieu of foreclosure will transfer the property’s title from the grantor to the grantee, who is also the mortgage owner. Since the mortgage owner takes possession of the property, the grantor need not pay back the mortgage, and the property is technically free of any debt or litigations as far as the grantor’s ownership is concerned.

Title Insurance

A property owner will have insurance to the title to meet any claims related to the title in the future. When the grantor sells the property to the grantee, they will require the grantee to buy the title insurance too. The grantee and purchase an additional policy if needed.

If the grantor is deceased or insolvent when the grantor raises a claim against the property’s title, the other deeds cannot help the grantee. With title insurance, this risk is removed.

Tips For Grantor and Grantee

The following points can help both a grantor and a grantee:

- Be sure to do a background check about the opposite party to ensure the payments and property are safe and legal.

- If you are going through a real estate agent, have your own lawyer go through the documents before you sign them.

- In case of deviations from the deed, ensure you follow the default clause and stick to the terms and conditions in the sale deed. Even if you make concessions and accept other terms orally, the court of law will not accept it.

Final Thoughts

Buying or selling a property is not a simple task. One needs to be meticulous in their documents to ensure there are no issues in the future. Be sure of the terms and conditions in the agreement before you sign it. If you are not sure about the meaning of certain terms, do enquire.