There is a lot more to buying rental property in real estate investing. It’s not always a straightforward investment. It would be best if you had pro forma calculations to ensure the profitability of a property before purchasing.

A carefully-crafted pro forma statement is one of the essential tools for investors looking to buy property. There’s no way to predict the future. Still, when deciding whether to invest in a property, you need to come up with “what if” scenarios to ensure you’re not flushing money down the drain on nonprofitable investments.

Let’s look at the pro forma definition real estate-wise.

What is pro forma in real estate?

The term “pro forma” has a Latin origin which literally means “as a matter of form” or “for the sake of form.” In real estate, pro forma calculates financial results and summarizes a property’s financial information.

A pro forma statement is a financial report based on assumptions and projections for your business. It focuses on the costs and cash flow. It shows lists of the actual income, expenses, and estimated income or a property’s projected net operating income.

In simple terms, pro forma analysis can help buyers and sellers better understand what a property is worth and determine if a property is worth purchasing or not.

Pro forma in real estate and how to calculate it

A pro forma in real estate will detail your property’s cash flow and projected net operating income (NOI). There are several items to consider in a pro forma document, including the following:

Gross rental income (GRI). GRI refers to the potential revenue your property will bring in from rental payments if all the units are occupied before any expenses are accounted for.

Maintenance and Repair expenses. Estimate how much you would spend on repairs to the property each year. Real estate investors typically follow the one percent rule or one percent of the property value yearly. For example, if your property is valued at $300,000, repairs and maintenance costs will be around $3,000 per year.

Vacancy rate. Vacancy rate refers to how many units are vacant and unoccupied at any time.

Loan fees and mortgage payments. If you took out a loan to buy a property, you’d be paying a fixed monthly mortgage. This expense is included in the pro forma calculations. In most cases, investors include the mortgage payments in the rental cost for possible tenants.

For example, if your monthly mortgage is $900, your rental rate should be more than that. Suppose the rental rate in the area is lower than your monthly mortgage. In that case, it may be time to look for other possibly lucrative properties to invest in.

Management fees. If you have only one property, chances are you might want to manage the property yourself. You might want to hire a property manager if you have several properties. Consider the costs and fees involved in management fees in your pro forma calculations. If you manage the property, set aside a specific percentage cost to compensate yourself.

Miscellaneous expenses. Expenses paid for insurance costs, leasing, tax fees, legal fees, HOA dues, and other fees should also be included in the pro forma document.

The general formula real estate investors use is the following:

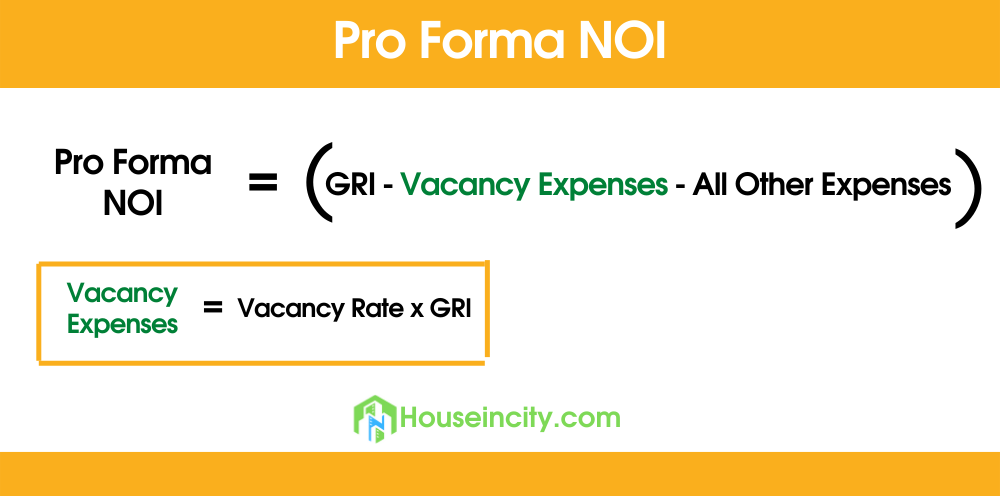

Pro forma NOI = GRI – Vacancy expenses – all other expenses.

To calculate the Vacancy expenses, multiply the vacancy rate by the GRI.

Types of pro forma statements

A financial statement is a pro forma example that includes three primary forms:

- Income statementsshow a company’s earnings, costs, and expenses over a specific period.

- Balance sheets- a report that provides information about a company’s assets, liabilities, and capital or net worth.

- Cash flow statements– report a company’s cash inflow and outflow.

In a nutshell, the financial statements show how a company’s financial position may change in the future. Pro forma financial statements will help you make a business plan, create a financial forecast, and get funding from potential lenders or investors. Pro forma documents are just estimates and assumptions

Bottom Line

Although everything is based on estimates and projections, a pro forma example document is vital to give you the complete picture of your risks and returns regarding your property. A pro forma document is a helpful tool to help you find safe, profitable investments in the competitive world of real estate.