If you wish to diversify your financial portfolio, real estate crowdfunding is one of the ways that you achieve this. This method of investing allows you to pull funds together with other investors and purchase a property collectively. This provides a great avenue to tap into real estate investments, making it easy to accumulate wealth and start investing in property ownership.

We will help you understand real estate crowdfunding and how to make such investments. Real estate crowdfunding platforms are available online, where money is pulled together, and properties are acquired. You get to learn this and more from our post.

What is real estate crowdfunding?

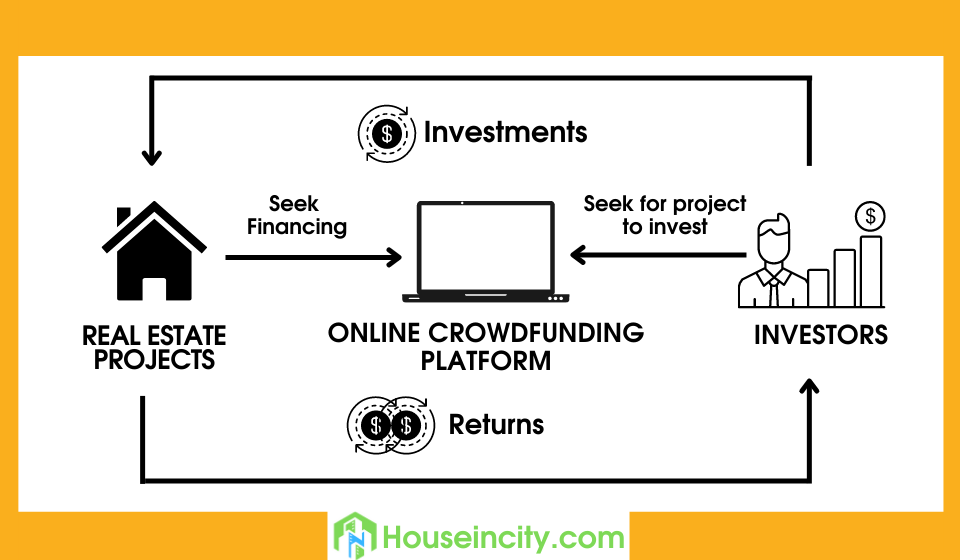

This is where the general public is asked to contribute startup capital to fund a new venture. In most cases, this is done through online fundraising, where potential investors get the information on websites. You learn of investment opportunities where investment concepts are pitched. The finances are pulled together for real estate investments.

Why are people going for these kinds of investment opportunities?

- Startup capital needed is small

- There are chances of diversifying the investment portfolio

- The risk is split among the different stakeholders

- One can invest in massive projects they would hardly invest

- You access the real estate market without giving upkeep or maintenance

- No regular payments on a mortgage

- No need for loan guarantees

How Does Real Estate Crowdfunding Work?

With real estate crowdfunding, you will not need a loan contract with a bank or investment firm. There will be no regular maintenance fees and mortgage repayments. Crowdfunding on real estate is flexible and easy to handle. It is a qualified form of generating passive income. With crowdfunding, you can get a one-time profit or regular income.

You can start your investment with as little as $500. The money you invest will go into Real Estate Investment Trusts (REITs). These trusts will hold the properties and run them. Property earnings will be issued as dividends and generate regular earnings.

Real estate crowdsourcing is done by privately-held REITs, which generate more revenue than publicly held REITs. In the same respect, higher returns mean that the risks come in equal measure. You need to do your research upfront and the investment money you can afford to forego if things do not go as planned. Use the crowdfunding real estate model to diversify your financial investments in bonds, equity holdings, and stocks.

Real estate crowdfunding platforms

There are a handful of crowdfunding platforms, some open to general investors, while others require you to be an accredited investor. As an accredited investor, you are required to have an income of $200,000 or a net worth of over $1 million to be a member.

You will come across plenty of firms competing to get investors for their new or already running projects. Some will provide details of their potential return on investment and tools to help keep track of your investments. Crowdfunding for real estate is a new practice, requiring you to conduct due diligence on the platforms offering these services. Find reviews from past or present investors with the platform. Look at the drawbacks of each portal to determine whether the risk will be worth it.

Pros and cons of commercial real estate crowdfunding

There are different things to consider before investing in the crowdsourcing world. You will get benefits and drawbacks, which will help determine whether the risk is worth taking. We have analyzed the model and put together some of the pros and cons of the investment.

Pros

- Better returns compared to traditional real estate investments

- Minimal initial investment

- Investing in unique projects and opportunities

- Diversity in the property investment portfolio

Cons

- Charges for management and advisory may be charged

- Some platforms may require accredited investors only

- There might be a lack of projects’ track record of success

How to get into real estate crowdfunding

Plenty of crowdfunding platforms are ready to take your contributions and invest in their projects. It would help if you were keen and researched these firms to ensure you get all the information right.

- Make a comparison of the sites you believe to suit your criteria

- Consider how much you are willing to invest without breaking the bank

- Do an estimate of the return on investment

- Consider the period the money will be tied up with the crowdfunding firm

- Check the form of property your money will be put into

- Have any form of documentation needed ready